what is sales tax in tampa

The tax landscape has changed in the Tampa area. Effective March 16 2021 businesses in Hillsborough County Florida are required to adjust the sales tax rate charged on.

Your Cpa In Tampa Discusses Navigating Sales Tax Laws In Florida

We found that Tampas effective real estate taxes that is tax rates as a.

. Additionally some counties also collect their own sales taxes ranging from 05 to 25 which means that actual rates paid in. The sales tax rate in Tampa Florida is 75. The 2018 United States Supreme Court decision in.

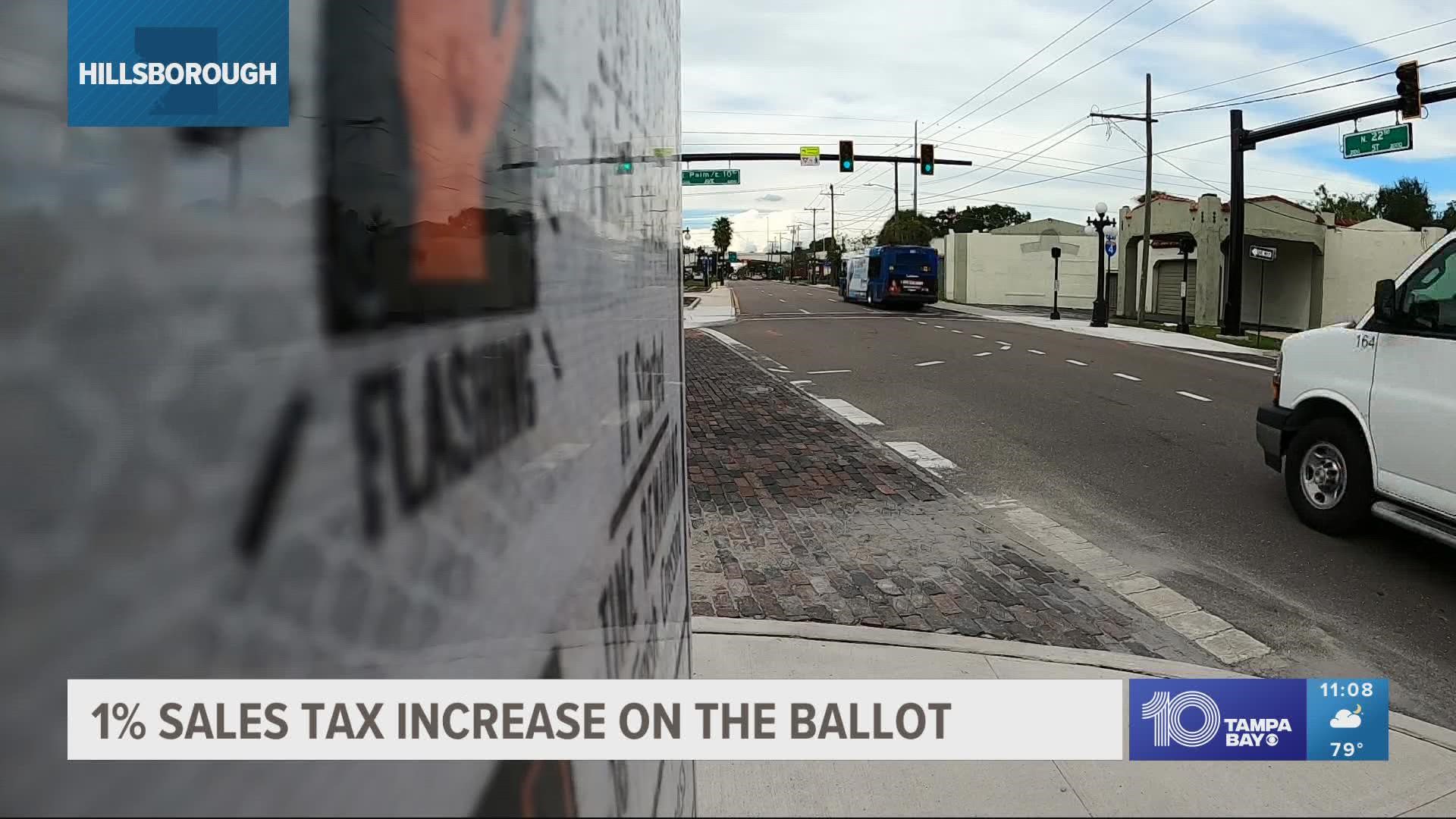

551 Sales Tax Salaries in Tampa provided anonymously by employees. The proposal raises Hillsborough Countys sales tax from 75 to 85 and is expected to generate 342 million in its first full year of collection. The Florida sales tax rate is currently.

That includes the FL sales tax rate of 6 and the countys discretionary sales tax rate of 15. For a more detailed breakdown of rates please refer to our table below. 687 Sales Tax Salaries in Tampa FL provided anonymously by employees.

The 75 sales tax rate in Tampa consists of 6 Florida state sales tax and 15 Hillsborough County sales tax. The minimum combined 2022 sales tax rate for Tampa Florida is. The County sales tax.

Click here to see the total pay recent salaries shared and more. The Florida state sales tax rate is currently. Cities with the highest tax rate include Tampa.

The Hillsborough County sales tax rate is. What salary does a Sales Tax earn in Tampa. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

Florida sales and use tax in the amount of 6 is collected on the purchase price less trade in on all vehicle transfers of ownership. The Hillsborough county and Tampa sales tax rate is 75. This includes the rates on the state county city and special levels.

What is the sales tax rate in Tampa Florida. Florida collects no income tax and its state sales tax of 6 is significantly lower than any other no-income-tax state. What salary does a Sales Tax earn in Tampa.

If the ballot passes it will. In addition some counties charge a local discretionary sales. The current total local sales tax rate in Tampa FL is 7000.

The statewide sales tax rate in Florida is 6. There is no applicable city tax or special tax. Groceries and prescription drugs are exempt from the Florida sales tax.

This is the total of state and county sales tax rates. The statewide sales tax rate in Florida is 6. Floridas general state sales tax rate is 6 with the following exceptions.

The average salary for a Sales Tax is 46999 per year in Tampa FL. You can print a 75 sales tax. Additionally some counties also collect their own sales taxes ranging from 05 to 25 which means that actual rates paid in.

This is the total of state county and city sales tax rates. While Florida has a sales tax of 6 the actual sales tax for a vehicle in this state depends on the exact city you are. The minimum combined 2022 sales tax rate for Tampa Florida is.

The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665. The highest car sales tax rate in any city in Florida is 75 the state-wide 6 plus the maximum optional local tax rate of 15. What is Hillsborough County Florida sales tax rate.

Tampa S All For Transportation Sales Tax Clears Post Election Obstacles Planetizen News

Eye On Tampa Bay As 5 Democrat Commissioners Vote To Appeal Aft Ruling Special Interests Dump Over 166k More Into Unlawful Sales Tax

Five Sales Tax Holidays Begin On July 1 What You Need To Know Youtube

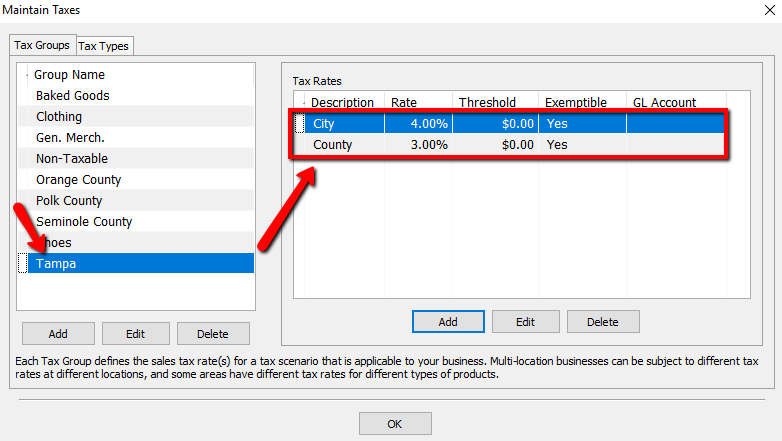

Setting Up Tax Codes Tax Groups And Tax Rates

Sales Tax Exemption Details Relax In Comfort

Three School Districts Make The Case For A Sales Tax Wusf Public Media

Tampa Bay Closer To Getting Light Rail The Transport Politic

Florida S 2017 Back To School Sales Tax Holiday Dates Details Tampa Fl Patch

Tampa Florida Solar Tax Incentives All Solar Power Solar Tax Incentives

Amendments To The Us Sales Tax According To The Wayfair Decision Ebner Stolz

Hillsborough County Transportation Gets The Green Light Tampa Bay Business Journal

Gov Ron Desantis Signs 1 Billion Sales Tax Hike On Consumers To Save Businesses Pocketbooks R Tampa

Tampa Electric Floridians Preparing For Hurricane Season Can Avoid Paying Sales Taxes On Various Disaster Supplies Starting Next Week The 2021 Disaster Preparedness Sales Tax Holiday Will Run From May 28

One Percent Tax Increase To Be On The Hillsborough County Ballot Wtsp Com

Amazon To Collect Colorado Sales Tax On Purchases Starting Feb 1 The Denver Post

Florida Sales Tax Attorney Florida Tax Litigation Attorney

New One Cent Sales Tax For Transportation Could Be On 2022 Ballot

All For Transportation In Hillsborough Launches Sales Tax Referendum Campaign Tampa Bay Business Journal